Intangible Assets / IA Audits

-

The Rise of Intangible Assets: Unlocking Value in the Modern Business Landscape

-

In today’s knowledge-driven economy, intangible assets have emerged as a vital driver of business value and competitive advantage. Discover their importance and how they can propel businesses to new heights.

The modern business landscape has seen a remarkable shift in the sources of value creation. Intangible assets, such as intellectual property, brand equity, and human capital, have become increasingly important drivers of business success in the knowledge-driven economy. This article will explore the various categories of intangible assets and their significance in today’s competitive market.

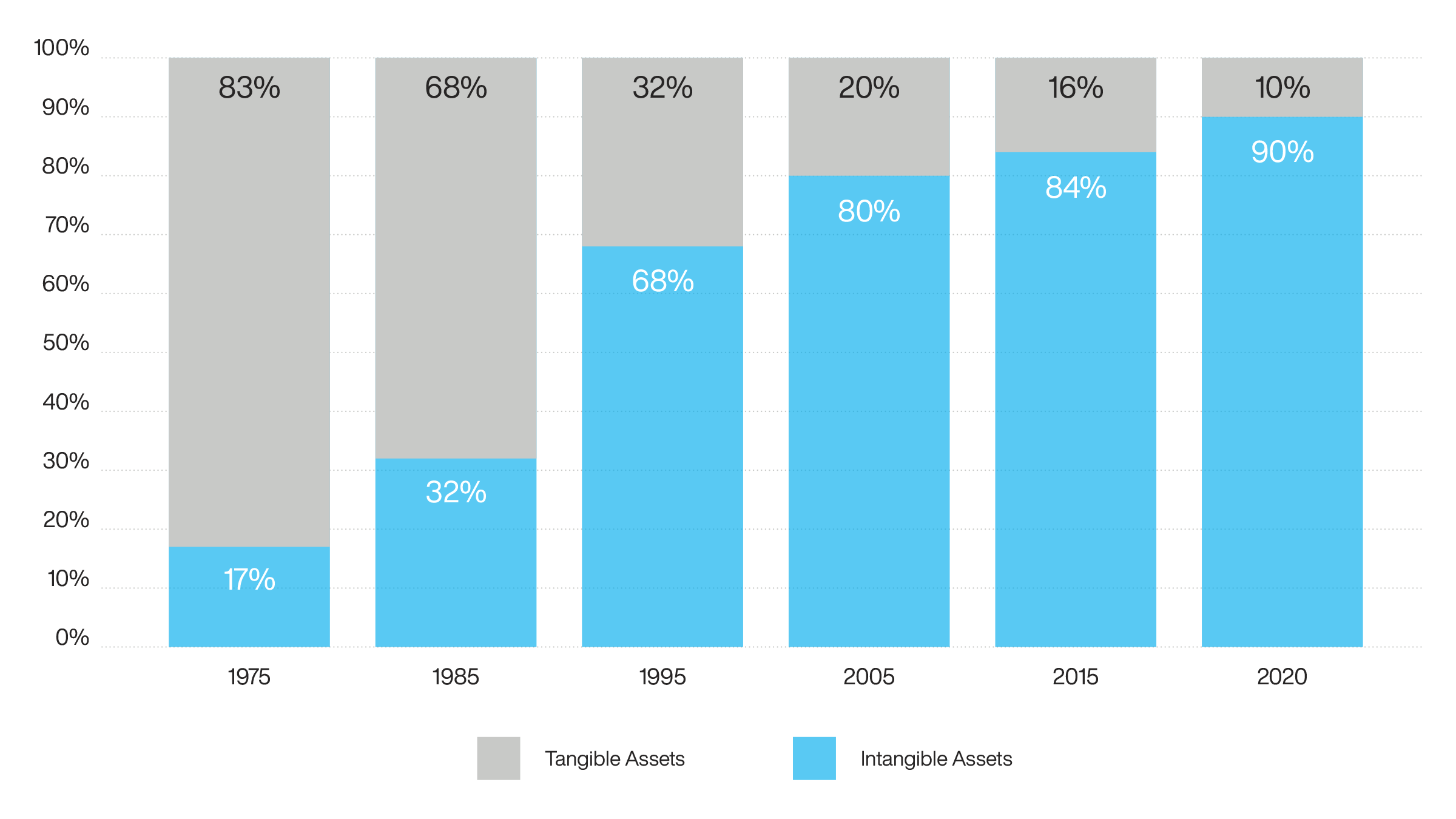

Tangible and intangible assets as percentage of S&P 500 market value 1975 to 20201

1. Ocean Tomo, a part of J.S. Held, Annual Study of Intangible Asset Market Value

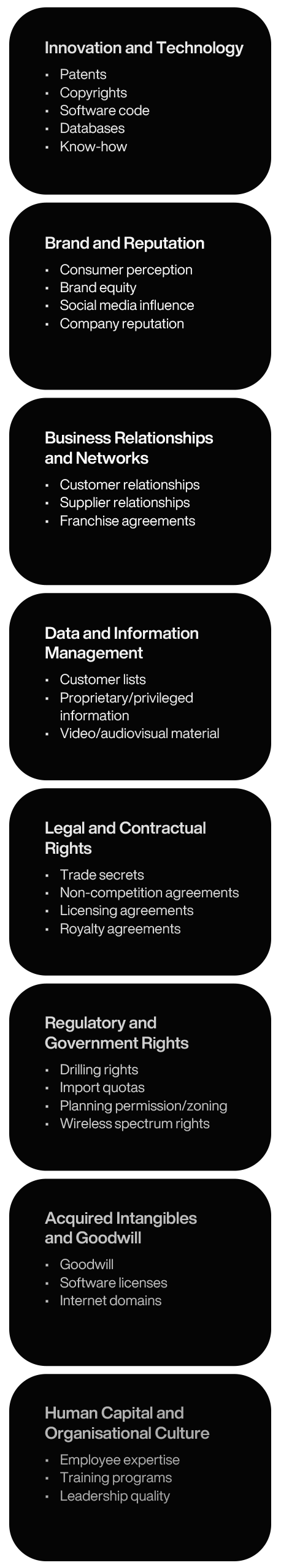

Intangible Asset Categories

-

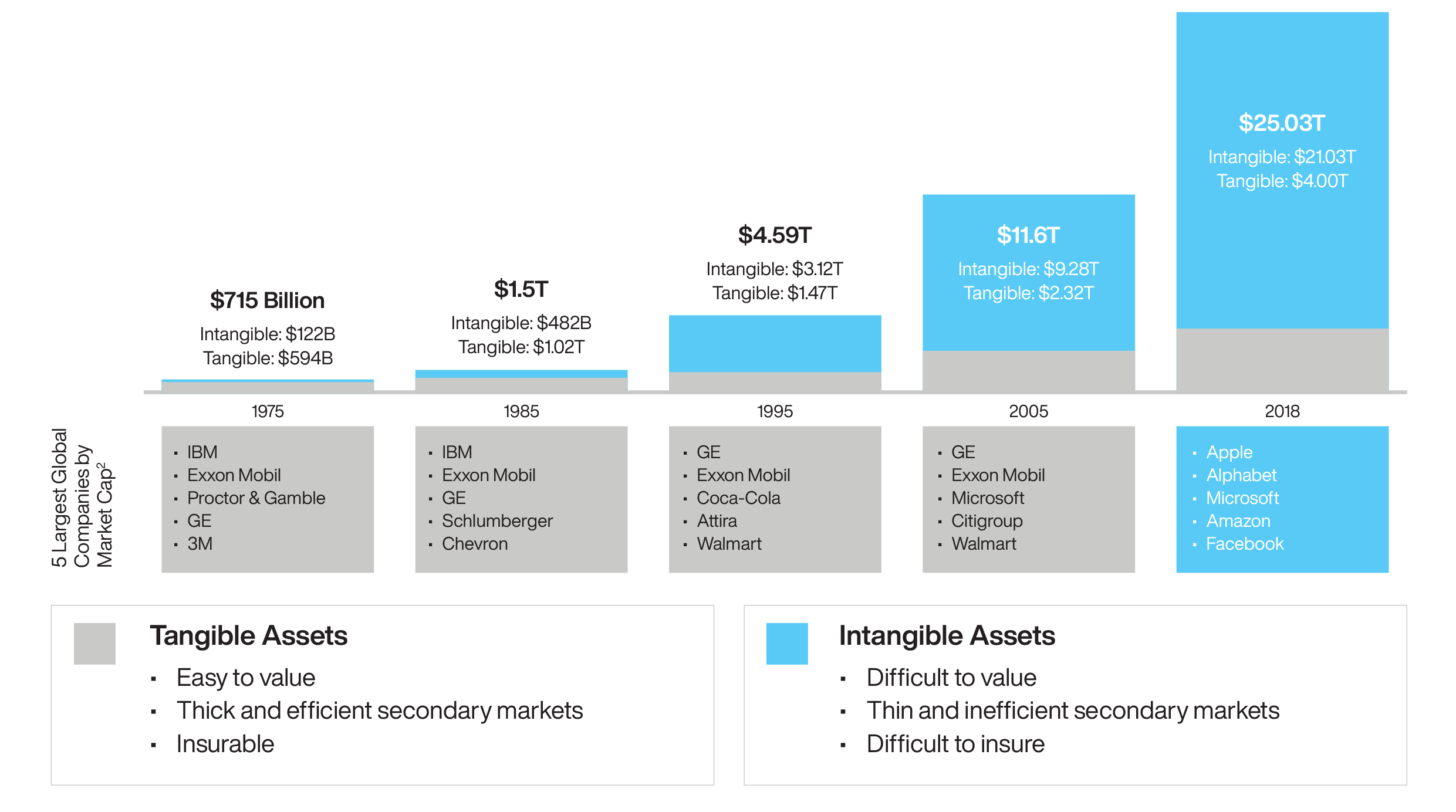

Historical Evolution from Tangible to Intangible Assets1

Tangible Assets vs Intangible Assets for S&P 500 Companies, 1975 – 2018

1. 2019 Intangible Assets Financial Statement Impact Comparison Report — Ponemon Institute LLC, April 2019

2. Five largest companies by market cap as of December 31, 2018Intangible Assets: A New Paradigm in Value Creation

Intangible assets are non-physical resources that generate value for a business. As opposed to tangible assets like machinery, real estate, and inventory, intangible assets are often difficult to quantify but can significantly impact a company’s performance and competitive advantage. The following categories of intangible assets showcase their diverse roles in value creation:

- Innovation and Technology: Patents, copyrights, software code, databases, and know-how drive innovation and technological advancements.

- Brand and Market Presence: Trademarks, brand equity, and social media influence build and enhance brand identity, market presence, and customer loyalty.

- Business Relationships and Networks: Customer relationships, supplier relationships, and franchise agreements derive value from the connections a company forms with its customers, suppliers, and partners.

- Data and Information Management: Customer lists, proprietary/privileged information, and video/audiovisual material enable the collection, analysis, and use of data and information to drive business decisions.

- Legal and Contractual Rights: Trade secrets, noncompetition agreements, licensing agreements, and royalty agreements protect the company’s legal and contractual interests.

- Regulatory and Government Rights: Drilling rights, import quotas, planning permission/zoning, and wireless spectrum rights are granted by regulatory authorities or governments.

- Acquired Intangibles and Goodwill: Goodwill, software licenses, and internet domains are acquired through mergers, acquisitions, or other business combinations.

- Human Capital and Organisational Culture: Employee expertise, training programs, and leadership quality drive performance and create value through the company’s workforce, organisational culture, and management practices.

Intangible Assets

-

Leveraging Intangible Assets for Business Success

To harness the full potential of intangible assets, businesses must adopt a strategic approach that includes:

- Identification and valuation: Determine the intangible assets in the organisation and assess their value, either through market-based, income-based, or cost-based approaches.

- Protection and management: Safeguard intangible assets by securing intellectual property rights, implementing robust data security measures, and enforcing legal agreements.

- Optimization and growth: Leverage intangible assets to drive innovation, improve operational efficiency, and enhance customer experiences, ultimately fueling business growth.

- Monitoring and reporting: Continuously track and assess the performance of intangible assets, incorporating their value into financial reporting and decision-making processes.

Embracing the Intangible Assets Revolution

As the business landscape continues to evolve, intangible assets have emerged as a vital component of value creation and competitive advantage. Companies that recognize and strategically manage their intangible assets are better positioned to thrive in today’s dynamic market. By identifying, valuing, protecting, and optimizing these assets, businesses can unlock new opportunities for growth, innovation, and long-term success.

-

The Importance of Intangible Asset Auditing

In the wake of the growing significance of intangible assets, it has become increasingly essential for businesses to conduct regular audits to effectively manage and safeguard their intangible resources. Intangible asset auditing is the systematic examination, assessment, and verification of the organisation’s intangible assets, ensuring their proper identification, valuation, and utilization.

Key Aspects of Intangible Asset Auditing

- Identification: A comprehensive audit starts with the identification of all intangible assets within the organisation. This involves reviewing various sources, such as financial statements, contracts, and intellectual property filings, to develop a complete inventory of intangible resources.

- Valuation: Once identified, intangible assets must be accurately valued using appropriate valuation methods. This may involve market-based, income-based, or cost-based approaches, depending on the nature of the asset and available information. Accurate valuation is crucial for financial reporting, strategic decision-making, and risk management.

- Legal Compliance and Protection: Auditing also encompasses verifying legal compliance, ensuring that the organisation has the necessary intellectual property rights and adheres to relevant laws and regulations. This includes checking the status of patents, trademarks, and copyrights, as well as evaluating the effectiveness of non-disclosure agreements and other legal instruments.

- Internal Controls and Risk Management: The audit process should assess the organisation’s internal controls and risk management practices related to intangible assets. This includes examining data security measures, access controls, and the management of third-party relationships to minimize risks associated with theft, misappropriation, or infringement of intangible assets.

- Insurance: Auditing intangible assets also involves assessing the adequacy of insurance coverage for these assets. This may include evaluating existing policies for intellectual property, cyber liability, and other relevant coverages to ensure the organisation is adequately protected against potential losses, legal disputes, or other risks associated with its intangible assets.

- Performance Monitoring and Reporting: Auditors should evaluate the organisation’s procedures for monitoring and reporting on the performance of its intangible assets. This includes the integration of intangible assets into key performance indicators, financial reports, and decision-making processes.

-

The Benefits of Intangible Asset Auditing

Conducting regular intangible asset audits provides numerous benefits to businesses, such as:

- Enhanced strategic decision-making: By gaining a comprehensive understanding of their intangible assets, organisations can make better-informed decisions regarding resource allocation, investment, and growth opportunities.

- Improved financial reporting: Accurate valuation and reporting of intangible assets enable businesses to present a more transparent and comprehensive view of their financial position, which is crucial for investors, creditors, and regulators.

- Risk mitigation: Regular audits help businesses identify potential risks associated with their intangible assets and implement appropriate measures to mitigate those risks, protecting their value and competitive advantage.

- Optimization of asset performance: Auditing can identify underutilized or underperforming intangible assets, enabling organisations to take corrective actions to optimize their performance and drive value creation.

By incorporating intangible asset auditing into their business processes, organisations can better manage, protect, and leverage their intangible resources, positioning themselves for sustained growth and success in the modern business landscape.

-

Further Reading

-

- Intangible Capital: Putting Knowledge to Work in the 21st-Century Organization by Mary Adams and Michael Oleksak

his book delves into the growing importance of intangible assets in the modern economy, offering a comprehensive framework for understanding, managing, and valuing intangible capital in organizations. - Capitalism without Capital: The Rise of the Intangible Economy by Jonathan Haskel and Stian Westlake

Haskel and Westlake explore the shift towards an intangible economy, discussing the implications of this transformation for businesses, governments, and society as a whole. - Intellectual Capital: The New Wealth of Organizations by Thomas A. Stewart

Stewart examines the role of knowledge and intellectual capital in creating value and competitive advantage for businesses, providing insights into how organizations can effectively manage these intangible assets.

- Intangible Capital: Putting Knowledge to Work in the 21st-Century Organization by Mary Adams and Michael Oleksak

-

- Driving Growth Through Innovation: How Leading Firms Are Transforming Their Futures by Robert B. Tucker

Tucker provides a roadmap for organizations seeking to harness the power of innovation, discussing the role of intangible assets such as intellectual property and organizational culture in driving growth. - The Invisible Advantage: How to Create a Culture of Innovation by Soren Kaplan

Kaplan explores the role of organizational culture as an intangible asset that can foster innovation and drive business success, offering practical advice on building a culture that supports innovation. - Intellectual Property Strategy by John Palfrey

Palfrey discusses the strategic importance of intellectual property as a key intangible asset, providing insights into the management, protection, and leveraging of intellectual property for competitive advantage. - Valuation and Dealmaking of Technology-Based Intellectual Property: Principles, Methods and Tools by Richard Razgaitis

This book offers a comprehensive guide to the valuation and dealmaking of technology-based intellectual property, helping businesses unlock the value of their intangible assets.

- Driving Growth Through Innovation: How Leading Firms Are Transforming Their Futures by Robert B. Tucker

-

- Intangibles: Management, Measurement, and Reporting by Baruch Lev

In this book, Baruch Lev, a leading expert on intangible assets, explores the role of intangibles in today's business environment. He delves into the challenges of measuring and reporting intangible assets, providing practical insights and recommendations for managers, investors, and regulators. The book emphasizes the importance of understanding and managing intangible assets to drive growth, innovation, and value creation in organizations. - Measuring and Managing Information Risk: A FAIR Approach by Jack Freund and Jack Jones

Freund and Jones present a comprehensive approach to managing information risk, emphasizing the importance of understanding the value of intangible assets such as data and information in driving business success. - The Knowledge-Creating Company: How Japanese Companies Create the Dynamics of Innovation by Ikujiro Nonaka and Hirotaka Takeuchi

This book investigates the processes through which Japanese companies create and leverage knowledge to innovate, emphasizing the importance of intangible assets in driving business success.

- Intangibles: Management, Measurement, and Reporting by Baruch Lev